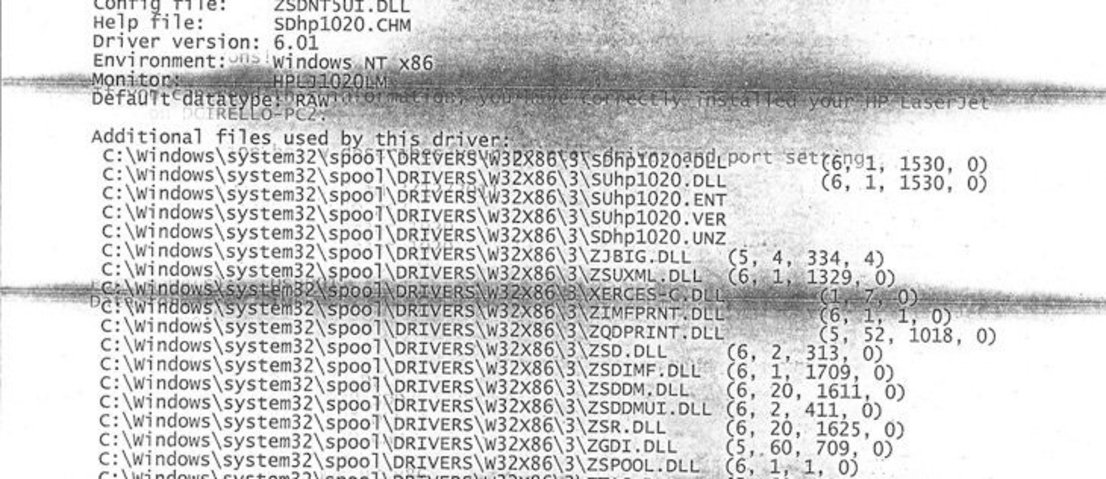

Canon : Manuales de MAXIFY : MB2700 series : El papel está en blanco/La impresión es borrosa/Los colores son incorrectos/Aparecen rayas blancas

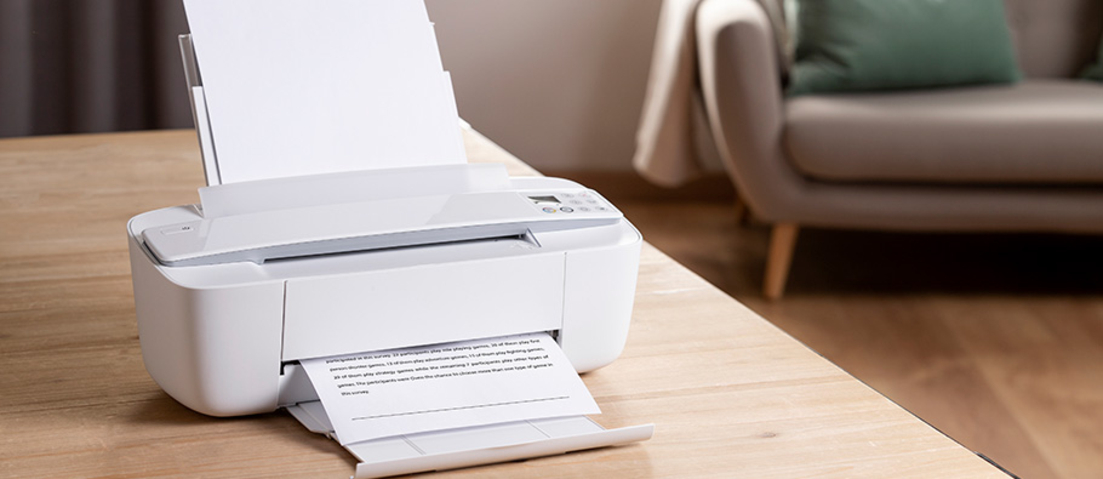

como dar mantenimiento a una impresora que imprime con rayas (test de inyectores) Epson l3150 - YouTube

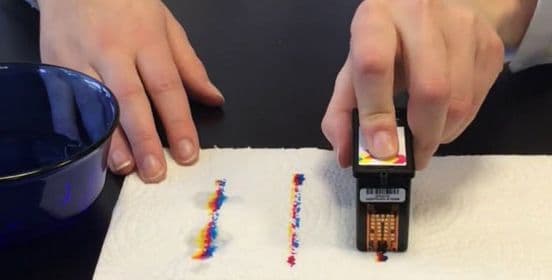

![Mi Impresora Imprime Con Rayas epson l375 l310 L220 l210 [Impresion de Test de inyectores SIN PC] - YouTube Mi Impresora Imprime Con Rayas epson l375 l310 L220 l210 [Impresion de Test de inyectores SIN PC] - YouTube](https://i.ytimg.com/vi/GxDio8AbQZo/maxresdefault.jpg)